Gilbert & Dean and Counterfeiting in Boston, 1806-1808

A combination of restrictive regulations and lack of available specie ensured that there was a persistent dearth of coinage in the British North American colonies over the course of the seventeenth and eighteenth centuries. One result of this lack of “hard” money was that the British colonists were the first society in which paper money became the predominant form of monetary exchange.

Despite the hopes of Benjamin Franklin and other promoters of the paper money experiment, the viability of the system was consistently threatened on two fronts. The first was the temptation that seemed to inevitably lead governments to print more money than could be covered by the treasury. The second was counterfeiting. The latter can be illustrated by the fact that the initial authorized issue of paper money was made by the colony of Massachusetts Bay in December 1690. The notorious counterfeiter Robert Fenton was brought up on charges for passing altered notes the following spring. The battle between authorities and counterfeiters was joined in earnest as the size and scope of paper money emissions expanded in the eighteenth century.

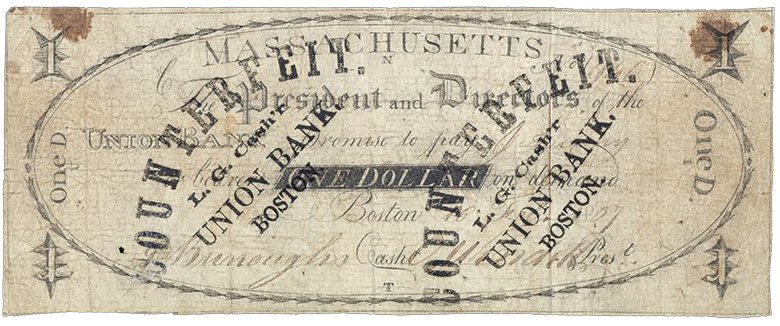

Colonial newspapers were replete with notices cautioning readers about circulating counterfeits and treasurers posted notices and broadsides for the public with instructions about how to identify false bills. As we have reviewed here before, the Continental Congress financed the revolution with huge emissions of paper money that the British attempted to undermine with organized counterfeiting. The excesses of the Continental Congress were such that “Continentals,” as the paper currency was known, depreciated to a point that they were practically worthless. Still, it enabled the rebellious colonists to win the war even though it poisoned much of the public on the viability of paper money as anything other than a emergency measure. Indeed, the Constitution specifically prohibited states from issuing paper money, but when the newfound US Mint was unable to meet the monetary needs of the populace in the 1790s, paper money in the form of promissory notes issued by private banks came to the fore.

By the early nineteenth century, the failures of the Continental currency had seemingly been forgotten as private banks around the country pumped a new flood of paper money into the economy. As with earlier emissions, this created opportunities for counterfeiters. Because each bank was issuing its own bills there was a certain amount of confusion among the public about what was what amidst the swirl of often crudely executed bank notes. This eventually gave rise to an entire genre of publications known as “counterfeit detectors” that we explored in part one of this series. But up until those serials were widely available in the 1820s, the public had to rely on a combination of common sense and luck to navigate the complexities of the emergent paper monetary system.

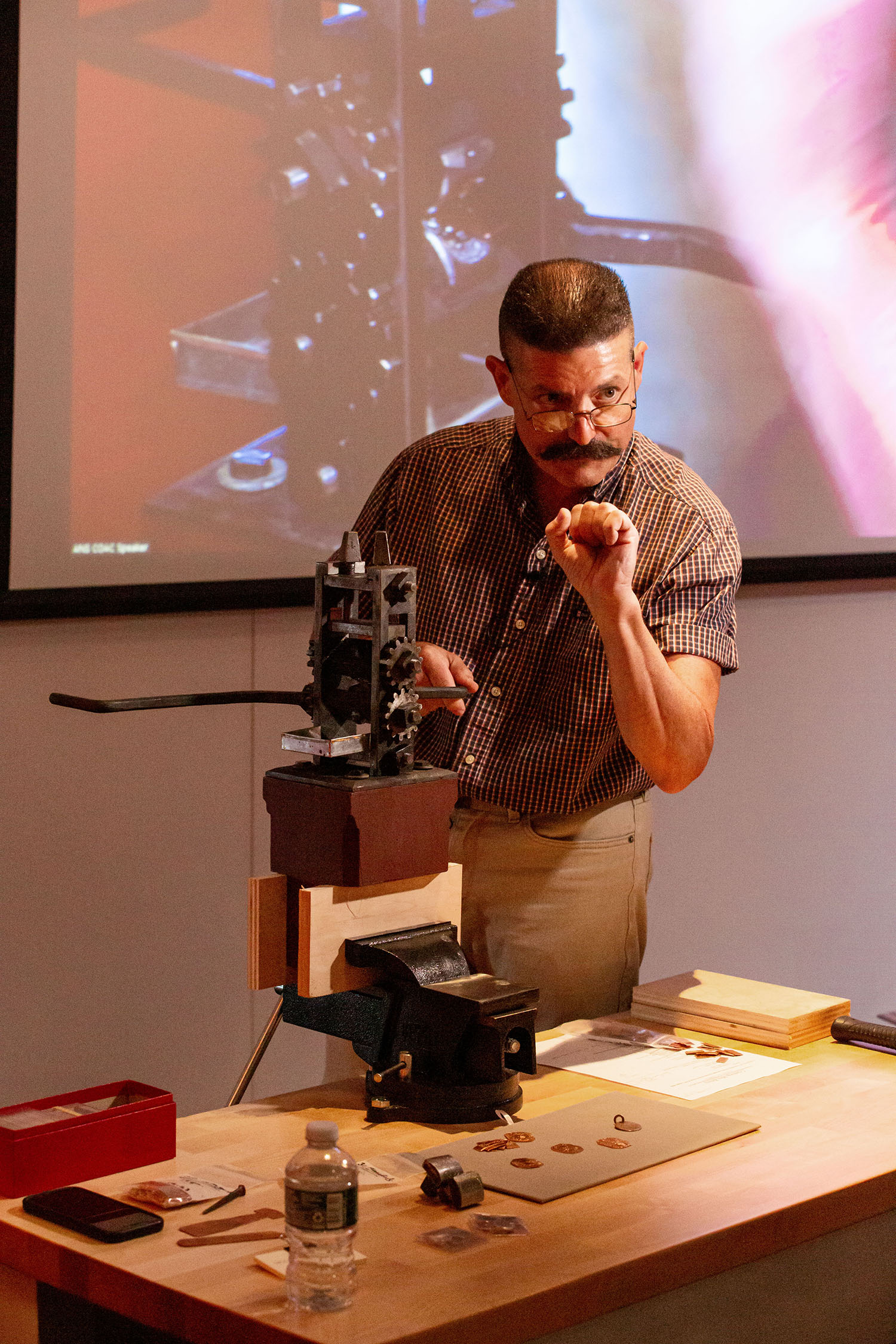

While newspapers occasionally carried warnings about counterfeiting activity, information often circulated more slowly than the fake bills. In the only significant study of the early organized effort to combat counterfeiting in print, William H. Dillistin highlights the seminal work of the Boston firm of Gilbert & Dean. Samuel Gilbert (b. 1777) and Thomas Dean (b. 1779) were trained as printers by the noted journalist and publisher Benjamin Russell. Their early partnership was centered on producing the Boston Weekly Magazine (1802-1808), which featured work from a variety of important early American writers, most notably Susanna Rowson. Seeing opportunities in the new economy, the partners gradually moved away from publishing into more speculative financial ventures as lottery, stock and exchange brokers.

The freewheeling commercial world that was budding in Boston during the early nineteenth century has been ably captured by Jane Kamensky’s The Exchange Artist (2008). Kamensky focuses on the story of Andrew Dexter, Jr., a speculator whose rise and fall served as a cautionary tale for the newfound banking and paper money industry.

The book is well worth a read, but the short version is that Dexter financed his schemes by gaining a controlling interest in a particular bank and then issuing more bank notes than the institution could ever possibly redeem. The most infamous of these was the Farmers’ Exchange Bank of Glouscester, Rhode Island, which issued an incredible number of notes beginning in the spring of 1808. Dexter quite literally used the bank to print money in order to finance an extravagant real estate project known as the Exchange Coffee House.

The scheme eventually collapsed when the public realized that the bank was unable to meet its extensive obligations, but knowledgable exchange brokers likely reaped a profit by divesting themselves of the specious notes in advance.

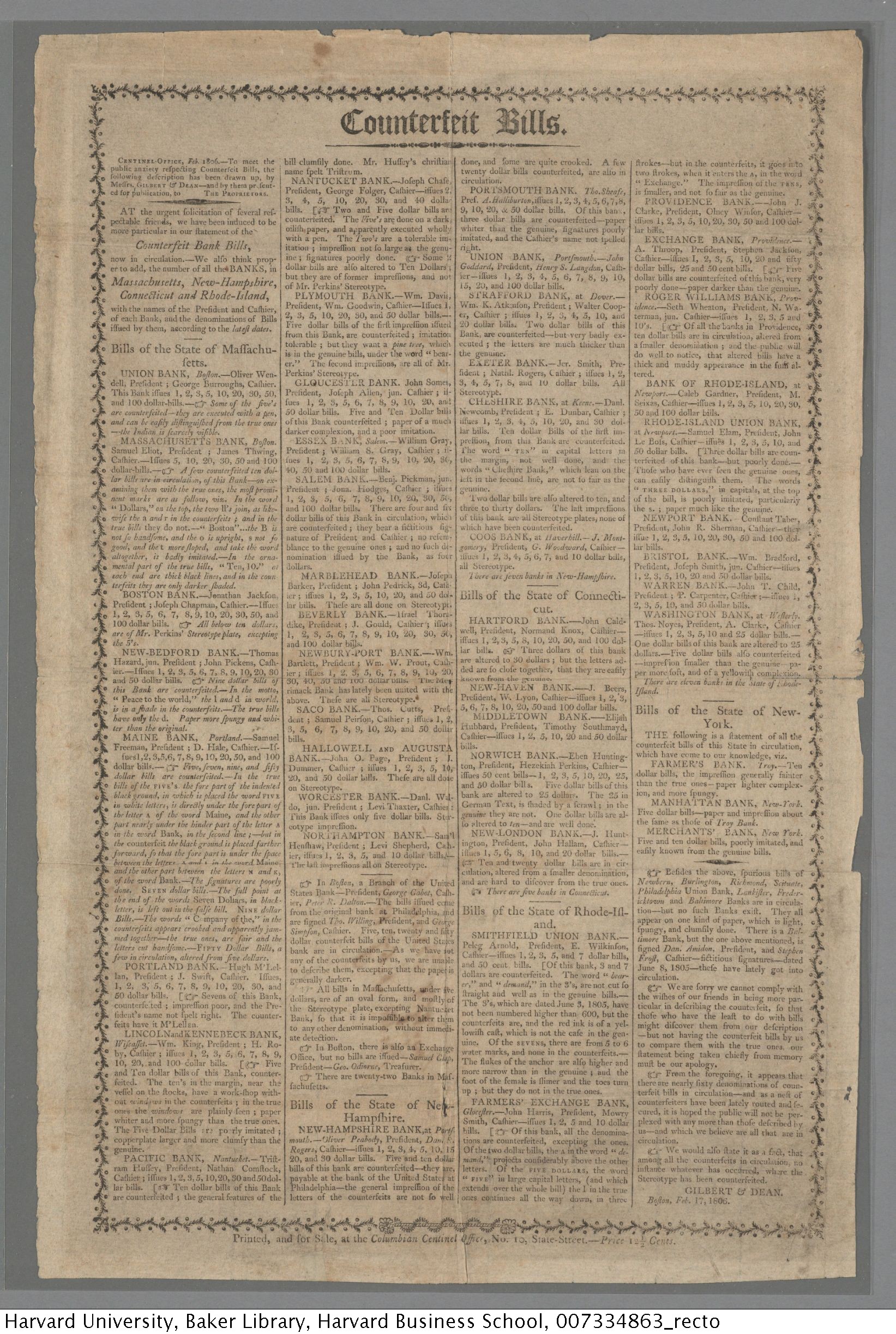

The public thus needed to be wary not only of counterfeiters, but of bankers as well. Uncertainty allowed exchange offices and information brokers like Gilbert & Dean a variety of ways to profit from their particular knowledge. In February 1806, the firm published a broadside (12″ x 18″) that promised “to meet the public anxiety respecting Counterfeit Bills” by listing known fakes in circulation and providing details about all of the regional banks that issued notes. The Baker Library at Harvard University has the only copy of this seminal counterfeit detector that we know of.

A typical description listed problems with the paper (too dark, too thin, etc.) or details like poorly set type and missing or altered elements for the public to ferret out fake bills. Gilbert & Dean were notably not doing this as a public service but to reap a profit, as the broadside cost 12 and a half cents (a bit or eighth of a dollar). Nearly fifty examples of counterfeit bills are noted, giving a good impression as to the scope of the problem.

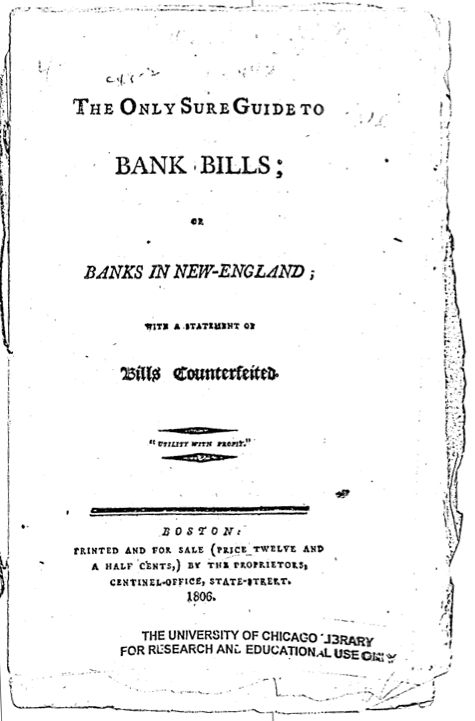

The broadside was such a success that the firm published a follow up during the summer of 1806. The Special Collections Research Center at the University of Chicago holds a copy of this rare pamphlet entitled The Only Sure Guide to Bank Bills; Or, Banks in Now-England: With a Statement of Bills Counterfeited. Promising “utility with profit,” it also warned:

If any one should suffer for want of information, rather than buy a pamphlet, the blame must attach to himself alone; and he will not receive that commisseration which in justice he ought.

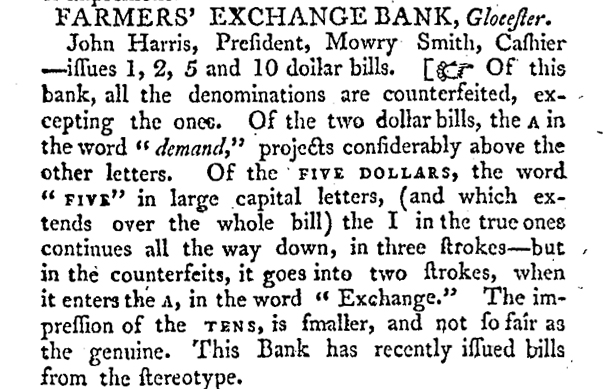

The twelve-page pamphlet provides details on forty-six banks while noting that there were seventy-four banks in operation in the whole United States, the balance of which were located in New England. The copy held at the University of Chicago includes a two-page “Postscript” dated a month after the original printing that updates some of the information therein. A typical entry read as follows:

Characteristic identifiers for the three counterfeit denominations were noted. Undoubtedly because of the extent of it, the last sentence notes that the bank was issuing new bills “from the stereotype,” which refers to a method developed by the inventor Jacob Perkins that used steel plates with intricate design features in an attempt to combat counterfeiting. The 1808 ten dollar note pictured above was one of the bank’s new bills produced using Perkins technique. Of course in the case of the Farmers’ Exchange Bank it was not counterfeiting, but the outright fraud of issuing of so many genuine notes that ended up fleecing the public in the end.

While Gilbert & Dean were providing information to the public for a seemingly modest price, behind the scenes they were also using their inside knowledge of the financial system to profit where they could. The firm’s links to the publishing industry afforded them the opportunity to paint banks in a flattering or unflattering light and as all paper money already circulated at a discount, they could to some extent manipulate the exchange value of given notes in ways that would benefit the firm. The number of court cases that Gilbert & Dean were involved in certainly suggests that they were not shy about using this leverage. An account of Gilbert and Dean v. The Nantucket Bank in July 1808 reads as an almost comical story about the lengths to which banks and brokers would go to impugn each other’s reputations. The firm brought the suit against the bank when its agent was seemingly unable to redeem a thirty dollar note for specie when he visited its office. Although the bank was undoubtedly engaging in some legal shenanigans and lost the case, its fear that Gilbert & Dean could ignite a run on the bank was certainly valid. There’s a reason that so many exchange offices and brokers were linked to publishing and the nascent counterfeit detecting industry; it gave them real power over how a bank and the paper money it issued was perceived by the public. In part three of this series, we will look at a New York City broker who played this game particularly well.

Finally, it should be noted that the counterfeiters themselves openly mocked Gilbert & Dean’s publications, which suggests that were not nearly as effective as advertised. In his wonderful memoirs, the criminal-cum-folk hero Stephen Burroughs included the text of a letter he purportedly sent to Gilbert & Dean in 1809 when he was one of the most prolific counterfeiters in the country.

Smithsonian National Museum of American History

The letter opened by noting that he had seen their Only Sure Guide to Bank Bills pamphlet and expressed admiration for their “kind labors for the public weal.” Burroughs sarcastically mocked the recent and spectacular failure of the Farmers’ Exchange Bank by suggesting only “Officers of the Pancake Exchange” could tell real pancakes from counterfeit ones. Gilbert & Dean probably did not care a whit about this as the firm ended up in control of the Exchange Coffee House that resulted from that epic swindle!