France: From the Franc to the Euro

From Napoleon to the Latin Monetary Union

From 1803 until 1914, France kept a stable monetary system based on convertibility into gold and silver. That system led to the Latin Monetary Union in 1865, with France, Belgium, Italy, Switzerland, Luxembourg, and Greece.

20 franc (Napoleon I), 1813. Gold, 6.43 g. Genoa (ANS 1966.164.465, bequest of A. Carson Simpson).

5 franc, 1813. Silver, 24.98 g. Rome (ANS 1923.999.260).

5 franc, 1878. Silver, 24.95 g. Bordeaux (ANS 1897.28.7, gift of Daniel Parish, Jr.).

20 franc, 1893. Gold, 6.45 g. Paris (ANS 1958.74.10, gift of G. Montabert).

100 franc, 1911. Gold, 32.25 g. Paris (ANS 1947.2.686, gift of W. B. Osgood Field).

Greece. 5 drachma, 1876. Silver, 25.07 g. Paris (ANS 1914.40.22, gift of Howland Wood).

This coin, actually minted in Paris, follows the standard of the Latin Monetary Union.

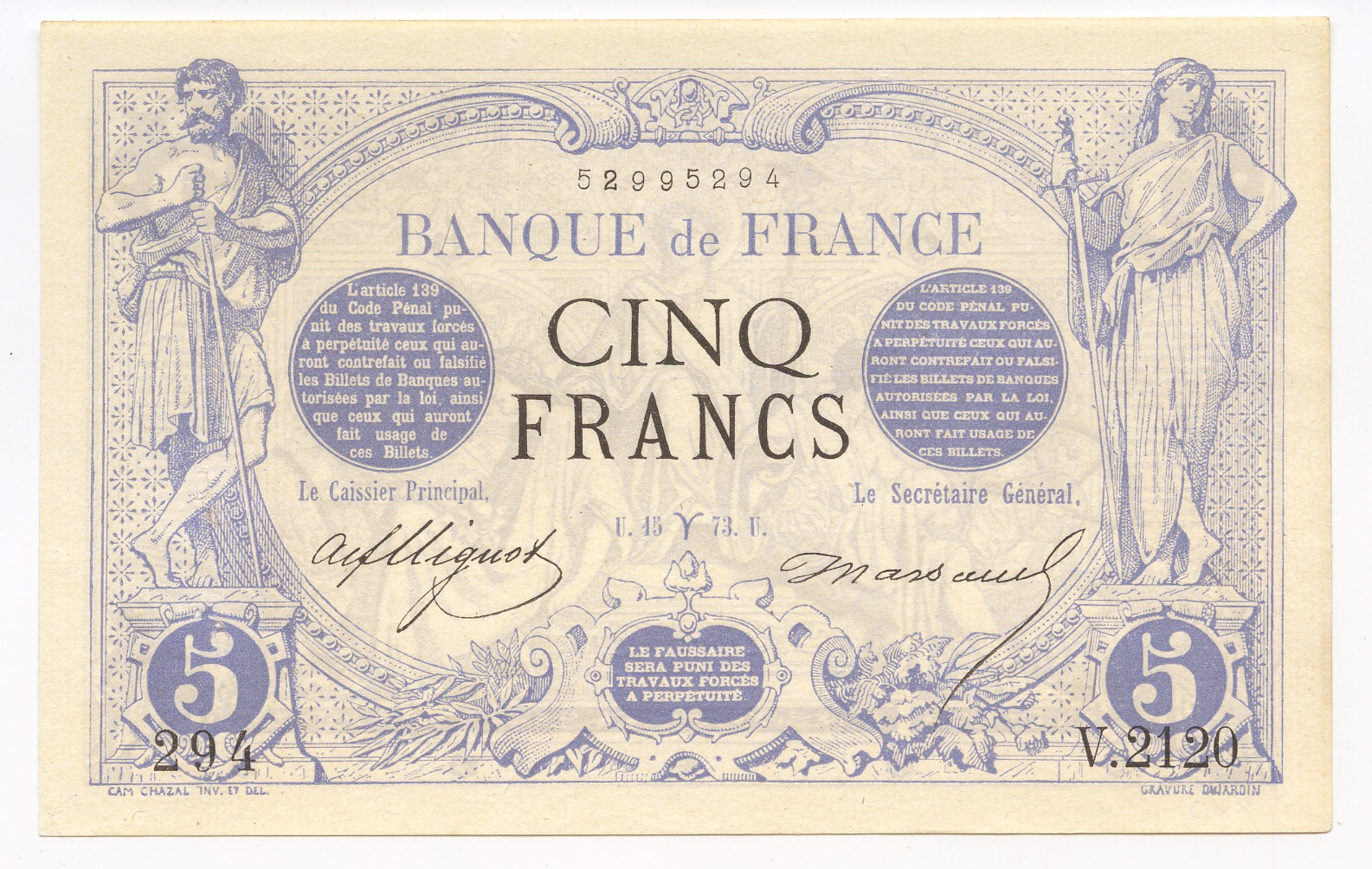

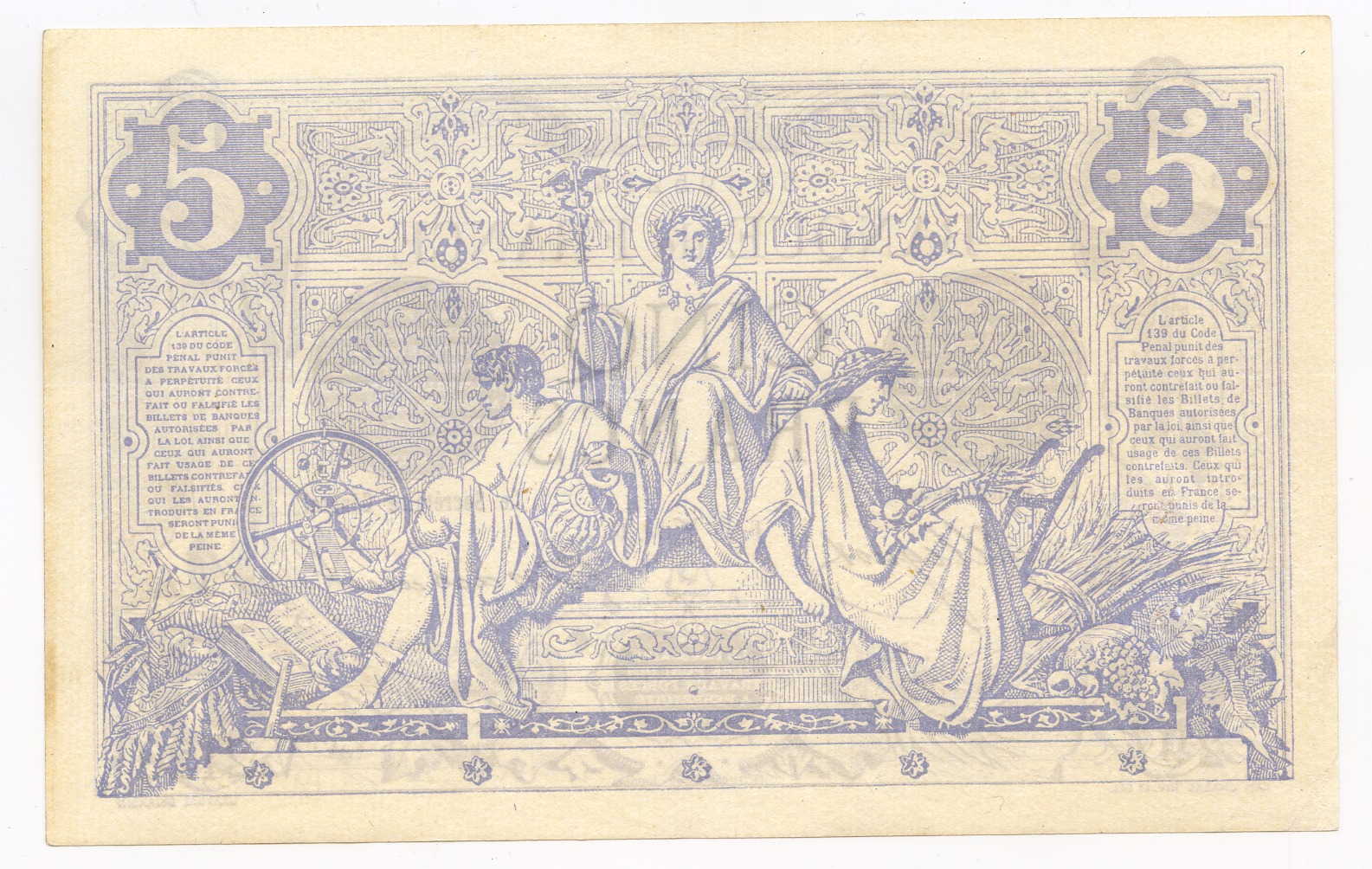

5 franc banknote, 1873 (ANS 1982.40.1).

The Bank of France enjoyed a monopoly of issue of banknotes after 1848. The notes were convertible in gold or silver. The coverage ratio by metallic gold was very high: in 1914, the notes’ circulation represented close to 6 billion francs, equal to 1,710 tons of gold, while the Bank of France kept 1,200 tons of gold in its coffers.

The World Wars and Inflation

With the First World War (1914-1918), gold convertibility was suspended. War expenses exceeded the government’s income from taxes, so that the notes’ aggregates grew well above their pre-war level. By 1918, France had lost over 2 million men to casualties or injuries and close to half of its industrial infrastructure had been destroyed. The US insisted on full dollar repayment of war debts, while there was little hope of collecting the war damages theoretically owed by Germany. The franc lost about 80% of its value against the dollar. In 1928, Prime Minister Raymond Poincaré linked the franc to gold again at 0.0655 g of 90% pure gold, hence making the 80% loss of value official. This did not last for long: the combination of depression in the 1930s and the build-up of the Second World War (1939-1945) led to renewed devaluations from 1936 onward. Retail prices, from an index of 100 in July 1914, reached over 500 in 1927. After a period of deflation between 1931 and 1935, inflation resumed and reached 26% in 1937, to remain above 20% per annum throughout the Second World War.

100 franc, 1935. Gold, 6.55 g. Paris (ANS 1980.109.1066, bequest of Arthur J. Fecht).

These coins had about the same module and weight as the former 20-francs pieces (see previous page). The coins were hoarded and barely circulated.

5 franc, 1933. Nickel, 12.03 g. Paris (ANS 1934.149.1, gift of J. Guttag).

Silver coins were no longer issued after 1920.

5 franc, 1933. Nickel, 5.99 g. Paris (ANS 1934.33.468).

In the period immediately after the Second World War, paper money was issued without limitation in an effort to help fund reconstruction. As a result, inflation went as high as 58.7% in 1948. As the franc was devalued within the Bretton Woods framework, one dollar went from 119.1 francs in 1945 to 350 francs in 1949. French coins and banknotes showed increasingly high notional values. In 1945, the franc represented 7.461 mg of pure gold, but by 1958 only 1.80 mg.

5 franc, 1949. Aluminum, 3.84 g. Paris (ANS 1984.38.52, gift of Robert L. and Marie Saxe).

100 franc, 1958. Cupronickel, 5.96 g. Paris (ANS 1981.30.145, gift of Howard W. Herz).

The metal value of this coin is negligible compared to the 6.55 g of gold needed to mint 100 franc coins merely 25 years earlier (see the example above).

5,000 franc banknote, 1957. Paris (ANS 1992.117.5010, gift of Arthur Mintz).

1,000 franc banknote, 1955. Paris (ANS 1992.117.5009, gift of Arthur Mintz).

Monetary Reform and the Euro

A major monetary reform led to the replacement of 100 “old” francs by 1 “new” franc in 1960. The new franc was worth 180 mg of pure gold, and 5 francs were worth 12 g of 83.5% silver. The franc’s metallic value was thus close to half of its 1914 value. This did not increase the net wealth of holders of old francs, since one needed 100 old francs to obtain 1 new franc. In 1969, the franc was devalued to 160 mg of gold. 1971 marked the end of gold as a general reference for monetary values.

10 nouveaux franc banknote, 1960. Paris (ANS 1992.117.5019, gift of Arthur Mintz).

This is strictly identical to the 1,000 franc banknote (see previous page). 10 new francs have replaced 1,000 old francs.

5 franc, 1962. Silver, 12.06 g. Paris (ANS 1964.34.36, gift of Paul Z. Bedoukian).

50 franc banknote, 1974. Paris (ANS 1992.117.5042, gift of Arthur Mintz).

500 franc banknote, 1975. Paris (ANS 2012.8.1, gift of Gilles Bransbourg).

This is the largest denomination issued by France between 1960 and the end of the franc in 1999. Prior to the reform of 1960, the highest denomination was a 10,000 francs banknote, equivalent to 100 new francs.

100 franc, 1982. Silver, 10.06 g. Paris (ANS 1983.121.1, gift of D. G. Briggs).

This coin type was never intended to circulate, and was minted and purchased for collection purposes. By 1982, 1 franc could buy about 0.7 g of silver at market price, so this coin’s intrinsic value was only about 21.5 francs, nothing close to its face value.

On December 31, 1999, the European currency (euro) was introduced. The euro banknotes and coins effectively began circulating on January 1, 2002, and the franc was withdrawn soon thereafter. The euro/franc exchange rate was fixed at 1 euro = 6.55957 francs. The highest denomination issued was the 500 euro banknote, worth about 3,280 francs. The issue of such as high denomination does not denote inflation, but rather cultural habits, notably in Germany, where users have long been accustomed to large notional values, like the 1,000-deutsche mark banknote. 500 euro are worth about $655 at current market value.

10 euro, 2012. 50% silver, 10 g. Paris (ANS 2012.8.2, gift of Gilles Bransbourg).

This series is directly inspired by the coins minted under Napoleon Bonaparte, and then under the Republic, until the early 1970s (compare to object number 3 above). Sold by the Monnaie de Paris at face value, the coin’s current intrinsic value is $5.90 or 4.50 euro. The 10-euro face value is equivalent to 6,560 pre-1960 francs. Between 1803 and 1914, 1 franc was worth 4.5 g of pure silver, and 6,560 francs represented 29,520 g of pure silver (=1,041 oz.), instead of the 5 g of today. This comparison provides us with a striking measure of the loss of monetary value in terms of silver that occurred in less than a century: 99.9831%.

(photo?)

50 euro, 2012. 1/4 oz gold, 8.45 g. Paris (Loan of Gilles Bransbourg).

This coin is a collectible object with a current intrinsic value of $425 or 325 euro, sold by La Monnaie de Paris for 490 euro. Using the same computation as above, this coin has a notional value of 321,419 pre-1960 francs based on the official sale price rather than the face value. 1 franc was worth 0.29025 g of pure gold in 1914, and 321,419 francs would have commanded 3,291 oz. of pure gold, compared with 0.23 oz. today. The loss of monetary value in terms of gold is 99.9930%.

The Growth of the Money Supply

Before the creation of money, pieces of metal including gold, silver, bronze and iron were used as a medium of exchange. Only new discoveries of metal could increase the monetary supply.

As soon as standardized money was created, political authorities began to debase their currency by manipulating weights and alloys. As a result, the same quantity of precious metals could be used to mint more coins.

Later, more sophisticated states, like the Roman Empire, converted existing coins into current prices using units of account that they could arbitrarily fix. As a result, later medieval states were able to debase, alter, or devalue their currencies to fund their deficits in times of war and crisis.

At the end of the medieval period, the emergence of a banking system led to the creation of fiduciary money. Money could be created through credit, without debasements or devaluations. As the public learned to accept paper money, modern European states were able to run unprecedentedly high deficits, which could be covered by flooding the market with paper money.

The resulting economic debt and inflation crises of the modern era eventually led to a return to a rather strict gold standard at the beginning of the 19th century. It collapsed during the First World War (1914-1918) to reappear under its weaker gold-dollar standard format in 1944.

After the final decoupling of money and gold in 1971, credit created new money under the supervision of the central banks. States nevertheless remained the primary source of monetary growth, as they controlled the central banks and could fund their budgetary shortfalls through monetary creation.

Central banks became independent from political authorities during the 1980s in an effort to ensure that states would no longer use their powers to monetize their deficits. Monetary creation became a monopoly of the banking system.

Since 2008, some central banks have decided to inject liquidity into the money supply chain by purchasing private and public debt. This allowed them to inflate monetary aggregates and thus avoid an economic depression.

Exhibition Parts

III. Rome: A Thousand Years of Inflation

IV. France: Inflation and Revolution